Risk Management

Risk Management Policy

In line with its philosophy of sustainable operations, Inventec strives to enhance its risk management framework by referencing the COSO Enterprise Risk Management, ISO 31000, and the “Risk Management Best-Practice Principles for TWSE/TPEx listed Companies.” The Company strengthens the effectiveness of its management and oversight of existing and potential risks by implementing an Enterprise Risk Management (ERM) system benchmarked against industry best practices. Through establishing, implementing, and maintaining a proactive risk management mechanism, Inventec aims to continuously monitor internal and external industry risk dynamics and enhance its ability to respond effectively and flexibly to relevant challenges, thereby safeguarding the best interests of customers and stakeholders. For the detailed policy, please refer to the Risk Management Policies and Procedures.

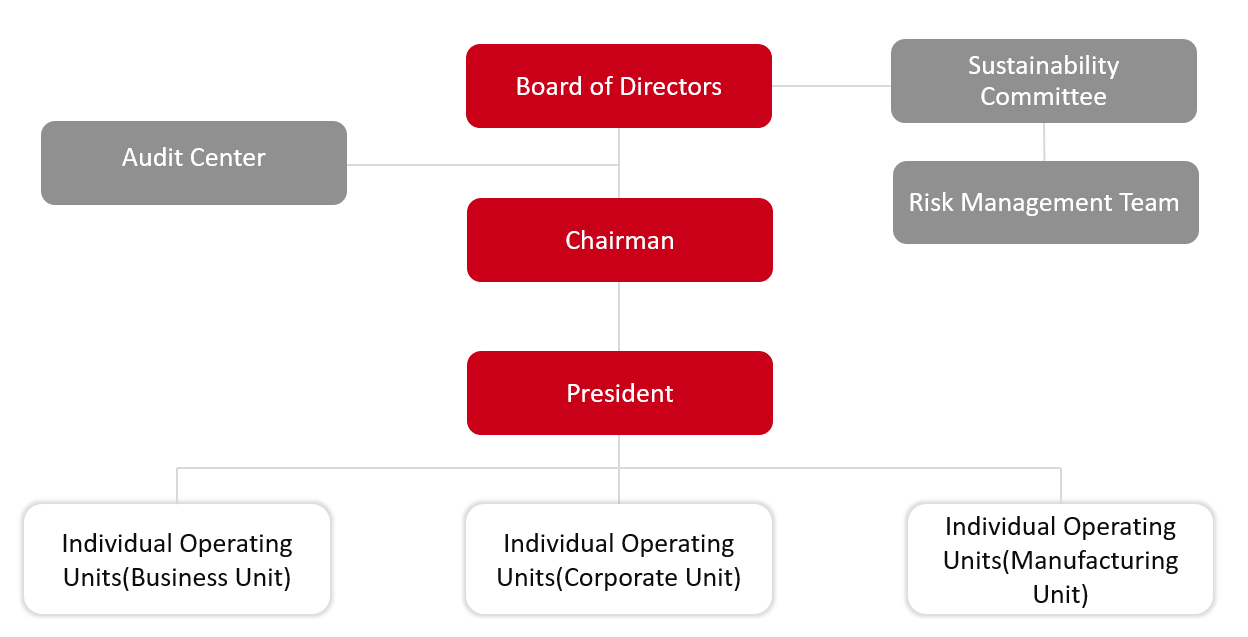

Risk Management Organization

- Board of Directors: The Board of Directors is the highest authority for risk governance and holds ultimate responsibility for risk management. Three Independent Directors on the Board possess expertise in fields including finance, legal compliance, securities, economics, business management, and risk management. These Independent Directors contribute professional insights and perform supervisory duties based on their knowledge, experience, and independence.

- Sustainability Committee: The Sustainability Committee, under the Board of Directors, holds the authority to supervise risk management and regularly reports to the Board on the implementation status of risk management each year.

- Risk Management Team: The risk management team is operating under the the Sustainability Committee. The Head of the Finance Center serves as the primary convener and appoints colleagues across departments as members of the risk management team. The task force is responsible for driving risk management related initiatives, overseeing mechanism operations, and assisting and coordinating various units in executing risk management activities.

- Audit Center: The Audit Center, subordinate to the Board of Directors, is headed by the highest-ranking audit executive. As a dedicated unit, the Audit Center examines operational process risks and oversees risk controls. It operates as a completely independent unit and reports regularly to the Board of Directors and the Audit Committee each year.